The signs are everywhere. The cannabis industry is maturing. Capital is becoming more sophisticated and increasingly thoughtful about where to invest. There is an influx of tenured executives from other industries, like CPG or Food & Beverage, bringing their operational expertise to our emerging industry. Increasing product and process innovation are dramatically growing the addressable market for cannabis.

This growth makes competition in an already deceptively competitive industry that much fiercer. The result is that operators face more complex financial and operational decisions than ever before.

I previously outlined how some businesses, public or private, may struggle to survive this maturation process. But another sign that cannabis is growing up is the influx of sophisticated financial advisors into the space. Sharp Capital Advisors is just one example (though the best in my biased opinion) helping companies raise capital, sell their business, or navigate tough financial situations.

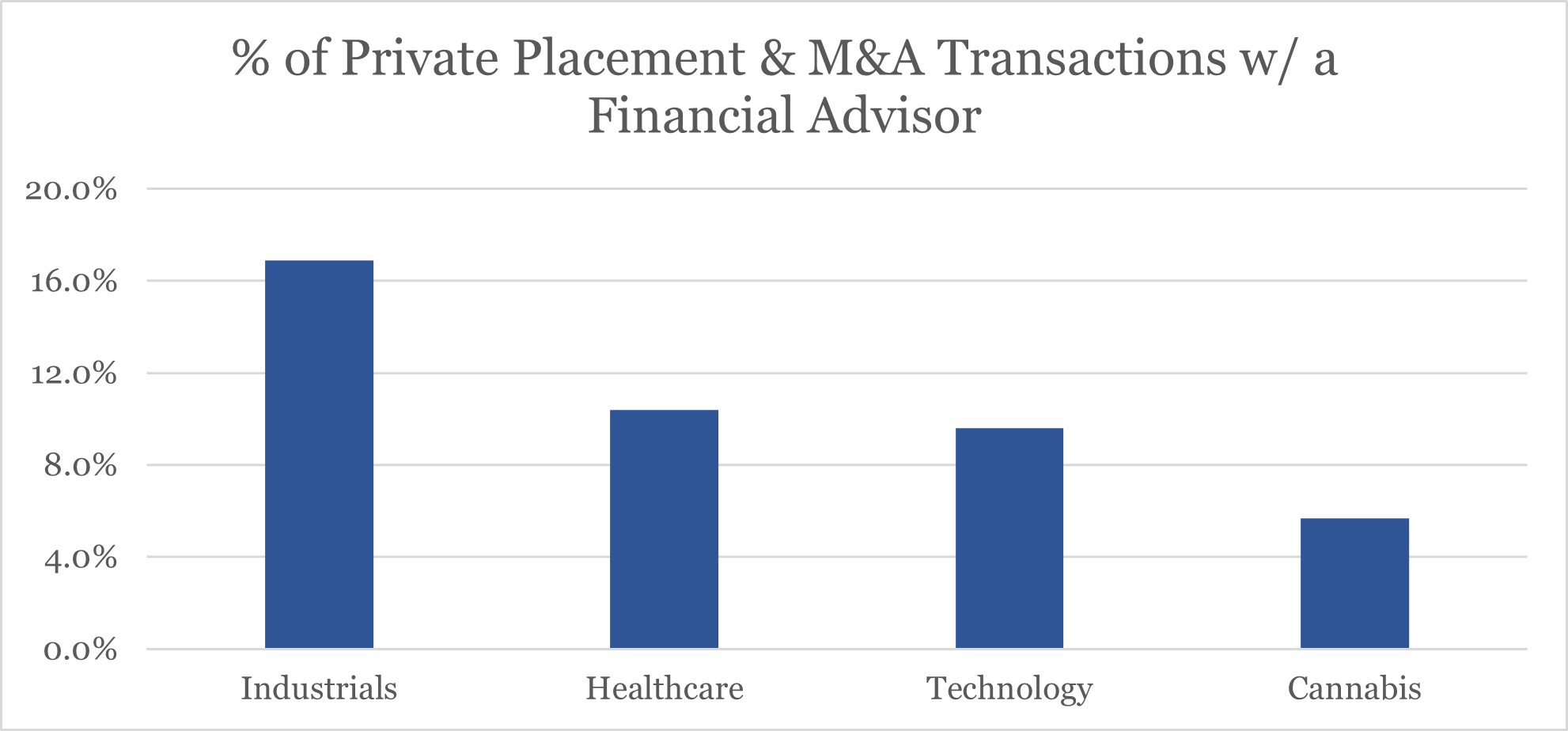

The cannabis industry is still getting comfortable with the idea of hiring investment bankers when the DNA of the industry has been more about strains than suits. In 2021, Cannabis companies hired financial advisors to assist with raising capital or M&A roughly half as often as businesses in other industries. Even less compared to some of the most mature sectors like Industrials.

It can be hard to appreciate the value of an investment bank when you are paying for strategy and advice as opposed to a tangible product. The return on the investment may only come at the end of a long auction-style process. Meanwhile, you seem to be getting unsolicited interest in your business from would-be buyers or investors.

Many of us have participated in a competitive auction process when buying or selling a home. As a seller, you typically wouldn't accept the first offer from somebody knocking on your door, and you would probably hire somebody to do all the work of marketing your home to maximize value. Well, if your home is typically your largest asset, your business is likely the only thing that might eclipse it. And it is infinitely more complex. So too is the process to sell it, especially in our industry. But how much value does an investment bank typically create?

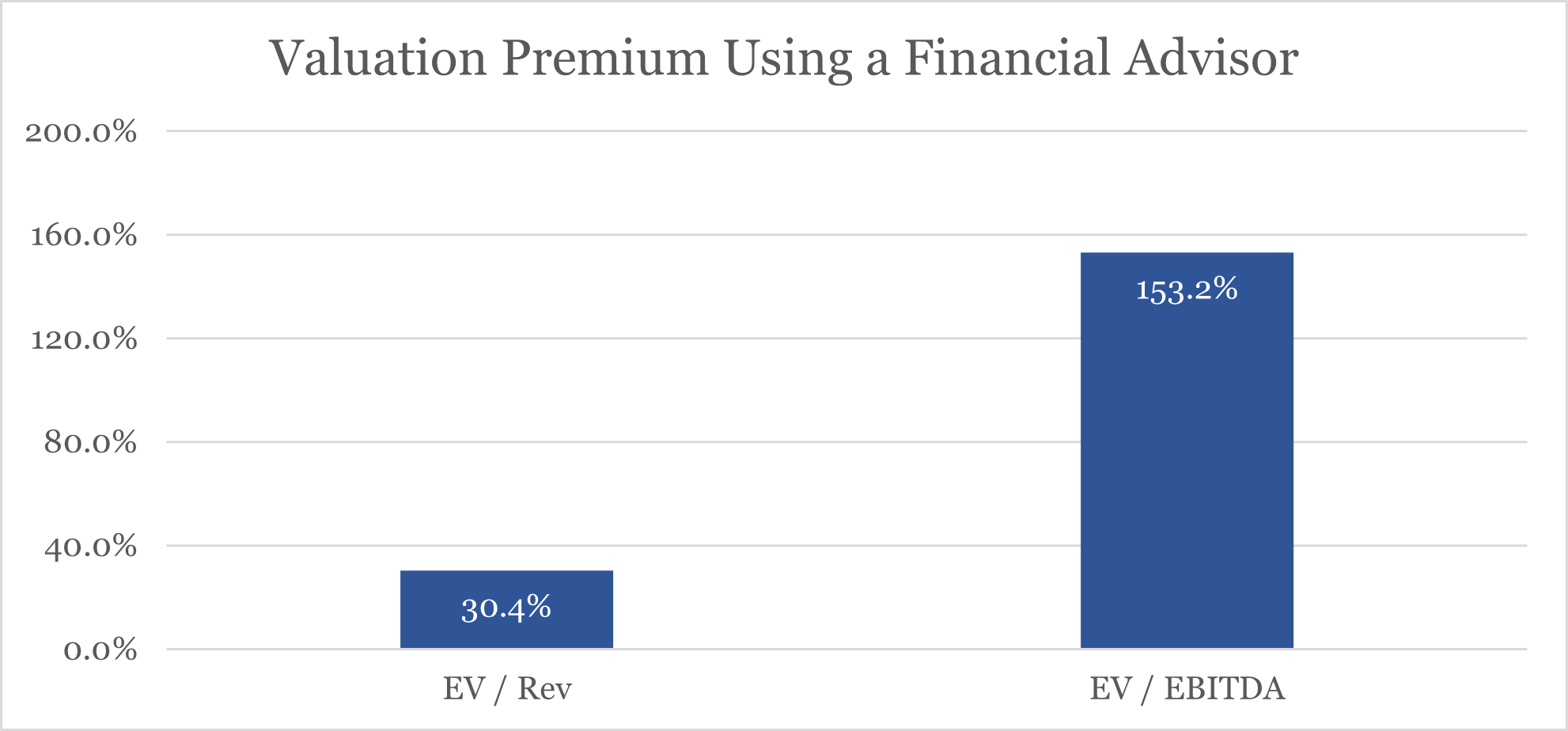

In 2021, banked cannabis transactions typically garnered a ~30% premium as a multiple of revenue and a ~150% premium as a multiple of EBITDA. I will note that available data in our industry is limited given the number of transactions and the proportion of those transactions that don't disclose financial information. But, to be fair, the same is true in other industries.

If there's one thing I want you to notice, it's that bankers can help businesses maximize their value and more than make up for their fee, netting more to the operators and investors than going it alone. You might question, how does a banker drive this value?

Ensure the company is prepared before launching a process

Approaching capital providers or buyers without the requisite preparation and documentation can signal a lack of sophistication or sincerity and prolong the diligence process. Elongated negotiations can break down trust between the two parties. As a result, the buyer often reduces the price or adds inferior terms to the initial proposal.

Do the heavy lifting so you can run your business

Any transaction process requires at least some attention from the management team, but non-banked deals more so. During a transaction, the last thing you want to do is take your eye off the (operations) ball and for the company to start underperforming leading up to a close. Underperformance is one of the main causes of capital getting skittish or buyers re-trading a deal at the 11th hour. Or worse, walking away entirely.

Signal to the market that they must compete to win this asset

Some buyers or investors assume they are alone in looking at a target when working directly with an operator. Without a sense of competition, these buyers or investors feel more comfortable offering below-market terms or value.

In some cases, they have been known to intentionally drag out processes to monopolize the leadership team's time to box out any other parties, establish enough of a personal relationship with the owners that they couldn't imagine their company in anyone else's hands, or create enough "deal fatigue" that a seller will be more likely to accept an offer that is below market.

Someone objective to negotiate on the seller's behalf

Hiring an investment bank allows owners to avoid negotiating directly with the other party. When an owner enters negotiations, there will often be challenging, uncomfortable conversations that can become emotionally charged. Many business owners stay in leadership roles following a transaction and work directly with the people who negotiated on the buyer's behalf. An advisor allows owners and key executives to insulate themselves from negotiations and preserve a positive working relationship with their new partners. Considering this transaction is often the most important deal of an owner's life, it is sensible to have a layer of protection between the seller and buyer.

Finally, maximizing valuation.

Hiring an investment banker, particularly one experienced in your company's sector, means an owner has someone who understands the appropriate valuation and terms for deals of the seller's size, characteristics, and industry on their side. It ensures a credible source to advise on where to negotiate, whether in value or structure, to ensure the deal outcome is as positive as possible.

The cannabis industry is marked by significant capital constraints. And the available capital is primarily concentrated in a limited number of large operating companies or investment firms. It can feel as though the leverage rests with an exclusive few while the mainstream canna-businesses are at a disadvantage. To achieve the best outcome for your business, you should consider starting conversations with seasoned financial professionals that understand the cannabis industry and can help you navigate the next phase of your business’s growth.